Long Term Care Insurance — Act Now!

By Terry Savage on June 16, 2020

One of the most tragic aspects of the coronavirus pandemic is that as of June 3, 42% of all COVID-19 deaths in the U.S. have come from nursing homes or assisted-living facilities. The statistics reinforce every senior’s desire to remain at home in his or her final years, which is only possible if you have the resources to afford this very expensive home health care — or if you have long-term care (LTC) insurance. Otherwise, state Medicaid programs provide care for the impoverished, though mostly in institutions.

Perhaps because of this growing awareness (or ongoing low interest rates earned by insurers), prices of the newest hybrid/combo LTC policies are starting to rise. David Phillips, an estate planning specialist and consumer resource for LTC insurance at ROP LTC (www.ropltc.com), has issued a warning of a 10% to 15% price increase on July 15 for new applicants for one of the best hybrid LTC policies for people under age 71. Other insurers are likely to follow.

Long-term care insurance: The basics

Traditional, annual-premium LTC insurance policies got a bum rap in recent years, as insurers unexpectedly raised the annual premiums. Then along came a new era in long term care policies — the “combo” or “hybrid” policies, most of which are based on a life insurance policy and offer a fixed one-time premium, or a series of fixed payments.

Combo policies offer both an expanded pool of benefits to be used for long-term care costs and a death benefit for the heirs if the care isn’t used (or a guaranteed return of premiums paid). Premiums can’t rise along the way because you either make one single deposit or, depending on your age, have the choice to spread out your deposits from five to 15 years. Either way, your premium will buy you an expanded guaranteed benefit pool of tax-free cash and/or a death benefit.

For example, Brian Gordon of Murray A.Gordon Associates Long Term Care experts (800-533-6242) offers this example of a combo policy for a single 60-year-old single woman using the Securian (Minnesota Life) SecureCare product.

The quotations assume good health at time of purchase, and a 90-day elimination or “waiting” period before benefits begin after a physician certifies her inability to do two basic activities of daily living or she becomes cognitively impaired. SecureCare pays out a cash indemnity monthly benefit, which means you could use the money to pay anyone, even a relative, to care for you, or to pay for a home health care aide or a care facility.

A single deposit of $100,000 into SecureCare would generate an initial monthly LTC benefit of roughly $4,000 per month, for six years — a total initial pool of benefits just over $318,000. But because a 3% compounding inflation rider was added, at age 85 the monthly benefit will increase to over $8,500 per month, for a total available LTC pool of $666,291 — more than 6.5 times her initial premium. Should she die without using the care, her heirs would receive a death benefit of nearly $110,000.

If instead of a single deposit she chose to deposit her $100,000 over 10 years — $10,000 per year, the overall benefits would be reduced by about 10%.

Act Now — Prices rise soon

David Phillips notes that a 60-year old married man could today make a $100,000 deposit into a policy with a 5% inflation rider that would increase his LTC benefits to over $1 million by age 85. But after prices rise on July 15, it will take an initial deposit of roughly $113,000 to get the same benefit.

It’s important to be guided in your purchase of LTC insurance by an independent and knowledgeable agent. I can highly recommend these three independent agents. (Note: I receive absolutely no benefit from these recommendations.)

—Brian Gordon at MAGA LTC, 800-533-6242 or www.Magaltc.com

—David Phillips at Estate Planning Specialists, 888-892-1102 or www.ropltc.com

—Phyllis Shelton at Got LTCi, 800-582-8425 or www.GotLTCI.com

Sadly, it has taken a pandemic to demonstrate the need for long term care insurance. But now you know. And if this purchase makes sense in your total finances, now is the time to act. That’s The Savage Truth.

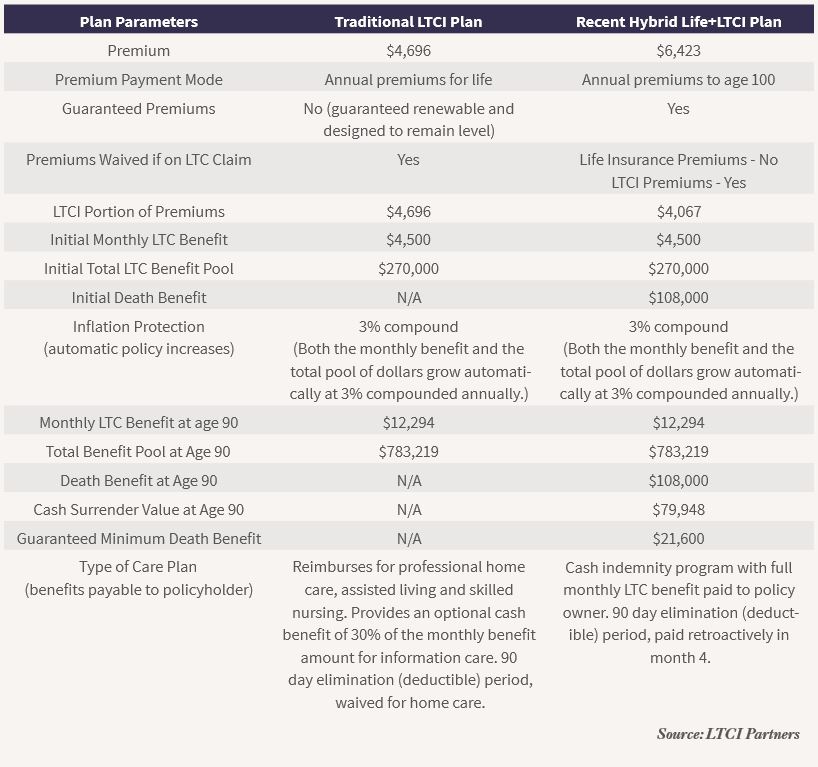

A PICTURE IS WORTH A THOUSAND WORDS! Thanks to Tom Riekse, Jr of www.LTCIPartners.com for this chart below: